Tax Accounting Vs Book Accounting . Leveraging both can help you and your business succeed at tax time. The following are just three of the most common textbook differences between book and tax accounting: In this publication we provide a. The key difference between tax accounting and book accounting is the purpose of the accounting. This whitepaper is the first in a. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Understanding tax basis vs book accounting are two different things.

from suppliernery.weebly.com

Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Understanding tax basis vs book accounting are two different things. The key difference between tax accounting and book accounting is the purpose of the accounting. In this publication we provide a. The following are just three of the most common textbook differences between book and tax accounting: This whitepaper is the first in a. Leveraging both can help you and your business succeed at tax time.

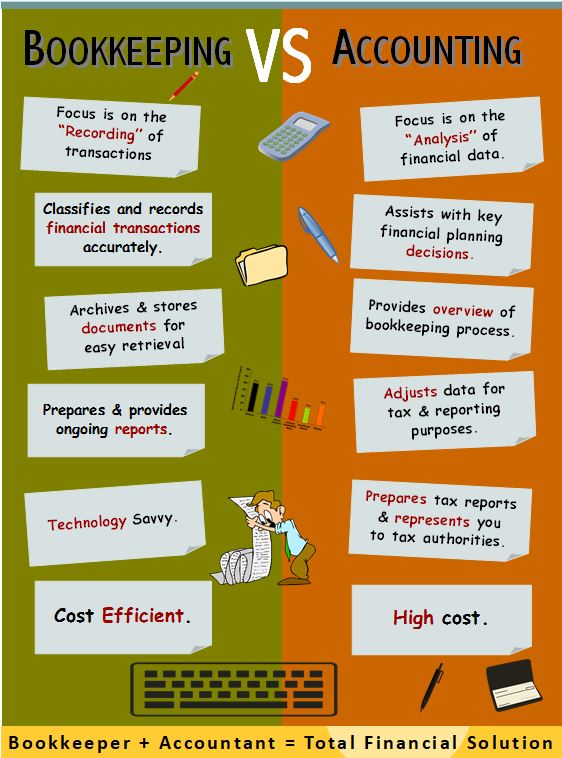

Difference between bookkeeping vs accounting suppliernery

Tax Accounting Vs Book Accounting This whitepaper is the first in a. The key difference between tax accounting and book accounting is the purpose of the accounting. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Understanding tax basis vs book accounting are two different things. In this publication we provide a. Leveraging both can help you and your business succeed at tax time. This whitepaper is the first in a. The following are just three of the most common textbook differences between book and tax accounting:

From efinancemanagement.com

Tax Accounting Meaning, Pros, Components and More eFM Tax Accounting Vs Book Accounting This whitepaper is the first in a. The key difference between tax accounting and book accounting is the purpose of the accounting. Leveraging both can help you and your business succeed at tax time. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Understanding tax basis vs book accounting are two different things. The following. Tax Accounting Vs Book Accounting.

From www.enkel.ca

Accountants vs. Bookkeepers What's the Difference? Enkel Tax Accounting Vs Book Accounting The key difference between tax accounting and book accounting is the purpose of the accounting. Understanding tax basis vs book accounting are two different things. The following are just three of the most common textbook differences between book and tax accounting: This whitepaper is the first in a. Fundamental to the income tax accounting framework is an understanding of deferred. Tax Accounting Vs Book Accounting.

From www.investopedia.com

Accounting Explained With Brief History and Modern Job Requirements Tax Accounting Vs Book Accounting Understanding tax basis vs book accounting are two different things. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. The key difference between tax accounting and book accounting is the purpose of the accounting. Leveraging both can help you and your business succeed at tax time. The following are just three of the most common. Tax Accounting Vs Book Accounting.

From www.educba.com

Types of Accounting 7 Different Types of Accounting with Explanation Tax Accounting Vs Book Accounting In this publication we provide a. The following are just three of the most common textbook differences between book and tax accounting: The key difference between tax accounting and book accounting is the purpose of the accounting. Understanding tax basis vs book accounting are two different things. Fundamental to the income tax accounting framework is an understanding of deferred tax. Tax Accounting Vs Book Accounting.

From www.akounto.com

Tax Accounting Definition, Principles, and Types Akounto Tax Accounting Vs Book Accounting This whitepaper is the first in a. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Understanding tax basis vs book accounting are two different things. Leveraging both can help you and your business succeed at tax time. In this publication we provide a. The key difference between tax accounting and book accounting is the. Tax Accounting Vs Book Accounting.

From webapi.bu.edu

😍 What is the difference between financial accounting and management Tax Accounting Vs Book Accounting Understanding tax basis vs book accounting are two different things. The key difference between tax accounting and book accounting is the purpose of the accounting. In this publication we provide a. Leveraging both can help you and your business succeed at tax time. This whitepaper is the first in a. Fundamental to the income tax accounting framework is an understanding. Tax Accounting Vs Book Accounting.

From www.bmsauditing.com

Accounting vs Bookkeeping What is the Difference? Tax Accounting Vs Book Accounting Understanding tax basis vs book accounting are two different things. The following are just three of the most common textbook differences between book and tax accounting: Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. In this publication we provide a. The key difference between tax accounting and book accounting is the purpose of the. Tax Accounting Vs Book Accounting.

From accountingcorner.org

Types of Accounting In Accounting Accounting Corner Tax Accounting Vs Book Accounting Understanding tax basis vs book accounting are two different things. The key difference between tax accounting and book accounting is the purpose of the accounting. In this publication we provide a. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Leveraging both can help you and your business succeed at tax time. The following are. Tax Accounting Vs Book Accounting.

From in.pinterest.com

Pin on Difference Between Bookkeeping vs Accounting Tax Accounting Vs Book Accounting This whitepaper is the first in a. The key difference between tax accounting and book accounting is the purpose of the accounting. Understanding tax basis vs book accounting are two different things. Leveraging both can help you and your business succeed at tax time. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. In this. Tax Accounting Vs Book Accounting.

From www.alamy.com

Accounting Chart Representing Balancing The Books And Paying Taxes Tax Accounting Vs Book Accounting The key difference between tax accounting and book accounting is the purpose of the accounting. In this publication we provide a. Understanding tax basis vs book accounting are two different things. This whitepaper is the first in a. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Leveraging both can help you and your business. Tax Accounting Vs Book Accounting.

From www.dreamstime.com

Accounting Pyramid Means Paying Taxes Auditing Stock Illustration Tax Accounting Vs Book Accounting The following are just three of the most common textbook differences between book and tax accounting: In this publication we provide a. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. The key difference between tax accounting and book accounting is the purpose of the accounting. Leveraging both can help you and your business succeed. Tax Accounting Vs Book Accounting.

From rmelbourneaccountants.com.au

Accounting vs. Bookkeeping Get to Know the Difference Reliable Tax Accounting Vs Book Accounting In this publication we provide a. The following are just three of the most common textbook differences between book and tax accounting: Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Leveraging both can help you and your business succeed at tax time. This whitepaper is the first in a. Understanding tax basis vs book. Tax Accounting Vs Book Accounting.

From khatabook.com

Tax Accounting Definition and Types of Tax Accounting Tax Accounting Vs Book Accounting The key difference between tax accounting and book accounting is the purpose of the accounting. The following are just three of the most common textbook differences between book and tax accounting: Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. In this publication we provide a. Leveraging both can help you and your business succeed. Tax Accounting Vs Book Accounting.

From www.basis365.com

Outsourced Accounting and Bookkeeping What's the difference? Basis Tax Accounting Vs Book Accounting The following are just three of the most common textbook differences between book and tax accounting: The key difference between tax accounting and book accounting is the purpose of the accounting. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. This whitepaper is the first in a. In this publication we provide a. Understanding tax. Tax Accounting Vs Book Accounting.

From quickbooks.intuit.com

Accounting vs bookkeeping What’s the difference between a bookkeeper Tax Accounting Vs Book Accounting The key difference between tax accounting and book accounting is the purpose of the accounting. The following are just three of the most common textbook differences between book and tax accounting: This whitepaper is the first in a. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. In this publication we provide a. Understanding tax. Tax Accounting Vs Book Accounting.

From www.pinterest.co.uk

Bookkeeper versus Accountant Bookkeeping, Accounting, Accounting Tax Accounting Vs Book Accounting The key difference between tax accounting and book accounting is the purpose of the accounting. In this publication we provide a. Understanding tax basis vs book accounting are two different things. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Leveraging both can help you and your business succeed at tax time. The following are. Tax Accounting Vs Book Accounting.

From profitbooks.net

Bookkeeping & Accounting Comparison Tax Accounting Vs Book Accounting Understanding tax basis vs book accounting are two different things. In this publication we provide a. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Leveraging both can help you and your business succeed at tax time. This whitepaper is the first in a. The key difference between tax accounting and book accounting is the. Tax Accounting Vs Book Accounting.

From synders.org

Tax Accounting for Business A Guide on Accounting for Taxes Tax Accounting Vs Book Accounting Leveraging both can help you and your business succeed at tax time. In this publication we provide a. The following are just three of the most common textbook differences between book and tax accounting: Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. Understanding tax basis vs book accounting are two different things. The key. Tax Accounting Vs Book Accounting.